Jewelry sales soared 32% during the 2021 holiday season, according to a newly released Mastercard report.

"Smaller boxes had a big impact," the report emphasized. "Whether consumers were shopping for themselves or for loved ones, the jewelry sector experienced some of the strongest YOY (year-over-year) and YO2Y (year-over-two-year) growth."

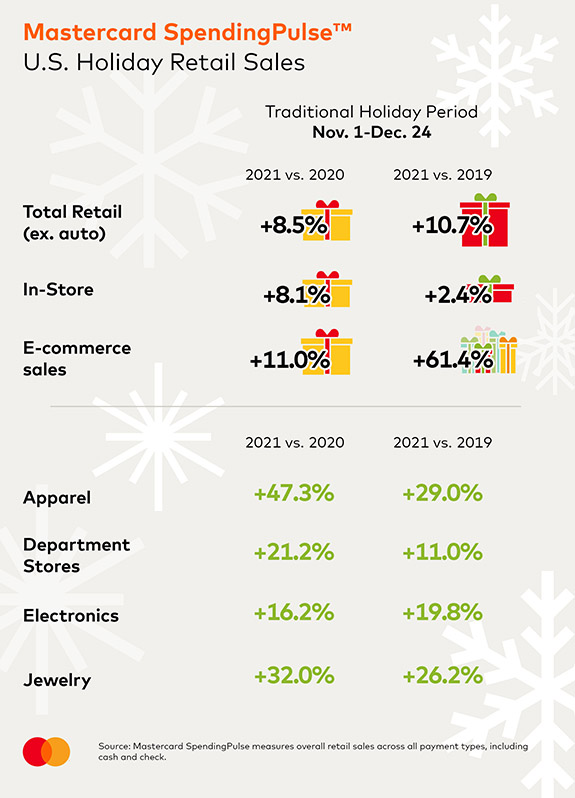

During the traditional holiday period that spans from November 1 through December 24, jewelry sales jumped a whopping 32% over the same period of 2020. When comparing the jewelry sector's 2021 performance to the pre-pandemic numbers of 2019, the jewelry sector was up 26.2%.

The only category to grow faster was apparel, which scored a 47.3% gain in 2021 compared to 2020, and a 29% boost compared to 2019.

According to the findings from Mastercard SpendingPulse™, which measures in-store and online retail sales across all forms of payment, overall holiday retail sales increased 8.5% in 2021 — the fastest pace in 17 years.

Consumers' pent-up desire to get back into the purchasing mode after a COVID-restricted 2020 holiday season more than compensated for their underlying concerns about higher prices, supply-chain disruptions and a new COVID variant.

Consumers shopped early. In fact, the season got its biggest boost from Black Friday and the Thanksgiving weekend. Retail sales activity during that three-day period was up 14.1%.

“Shoppers were eager to secure their gifts ahead of the retail rush, with conversations surrounding supply chain and labor supply issues sending consumers online and to stores in droves,” said Steve Sadove, senior advisor for Mastercard and former CEO and Chairman of Saks Incorporated.

The retail sales success was seen across multiple channels, as in-store sales grew 8.1% in 2021 versus 2020, and online sales surged by 11% over that same period.

According to the report, holiday season e-commerce accounted for 20.9% of total retail sales, up from 20.6% in 2020 and 14.6% in 2019.

Mastercard SpendingPulse™ reports on US retail sales across all payment types. The findings are based on aggregate sales activity in the Mastercard payments network, coupled with survey-based estimates for certain other payment forms, such as cash and check. “US retail sales” are defined as sales at retailers and food service merchants of all sizes. Services sectors, such as airlines and lodging, are not included.

Credit: Image by Bigstockphoto.com. Chart by Mastercard SpendingPulse™.